SOL/USDT Analysis – 1H Timeframe (March 13)

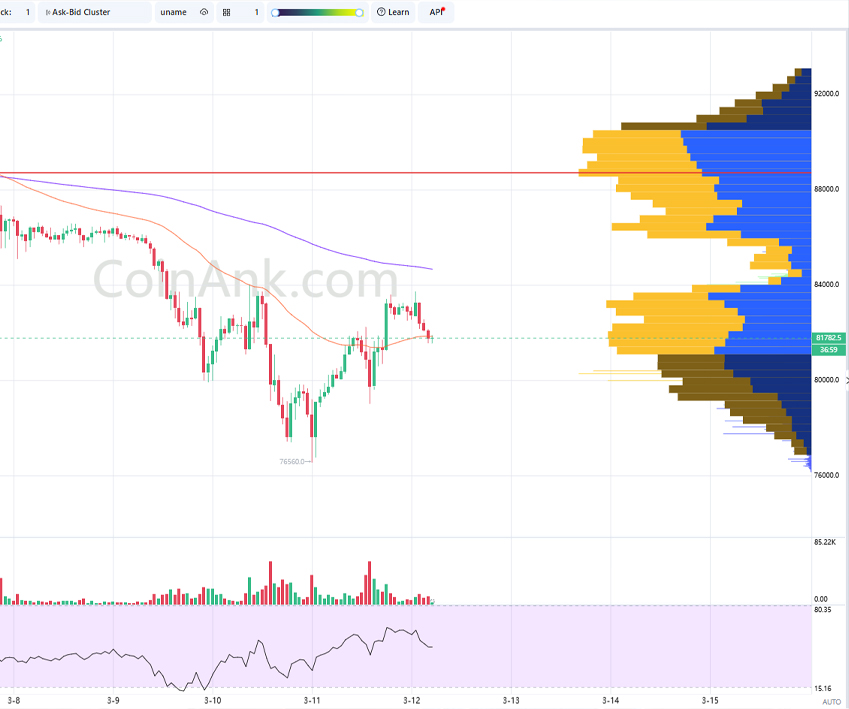

1️⃣ Trend & Market Structure (SMC)

- Main Trend: Bearish, price remains below EMA200.

- Break of Structure (BoS): Price is forming higher lows, showing signs of accumulation.

- Supply Zone (Resistance): $140 – $145 (POC + EMA200).

- Demand Zone (Support): $110 – $120 (High liquidity area).

2️⃣ Volume Profile (VPVR)

- POC (Point of Control): ~$144.84 (Key resistance).

- High Volume Node (HVN): $140 – $150 (Area with significant sell orders).

- Low Volume Node (LVN): ~$110 (Losing this level could trigger a deeper drop).

3️⃣ EMA (Exponential Moving Averages)

- EMA200 (Purple): ~$133 – Price is still below, no breakout signal yet.

- EMA50 (Red): ~$125 – Price is approaching, could retest.

- 🔹 Needs to break EMA50 and hold above $130 to sustain further upside.

- 🔹 If rejected at EMA50, price could return to the support zone.

4️⃣ RSI (Relative Strength Index)

RSI (14): ~53.80, slightly above neutral, showing signs of mild recovery.

If it surpasses 60, a stronger bullish momentum could be confirmed.

🎯 Trading Strategy

📉 Short Scenario (If Price is Rejected at Resistance)

Entry: $130 – $135 (EMA200 resistance).

Stop Loss: $140.

Take Profit:

- TP1: $120.

- TP2: $115.

- TP3: $110.

Condition: RSI stays below 60 + price rejection at EMA200.

📈 Long Scenario (If Price Holds Support and Breaks EMA200)

Entry: $120 – $125 (VPVR support + EMA50).

Stop Loss: $118.

Take Profit:

- TP1: $130.

- TP2: $140.

- TP3: $150.

Condition: Price holds above EMA50 + RSI stays above 50.

5️⃣ Conclusion

- Main Trend: Bearish but showing signs of accumulation.

- Key Resistance: $130 – $135 (EMA200 + POC).

- Strong Support: $110 – $120 (Volume Profile support zone).

- Main Strategy: Wait for breakout confirmation or short in line with the trend.

⚠️ Be patient, avoid FOMO without clear signals! 🚀

* Sign up for Binance to trade: Here

* Telegram: 3aW Crypto